CLARIFICATION MEMO ON ALLYSWIFT.EXCHANGE

1. Purpose of Memo

This memo provides a comprehensive clarification of the operational structure, reserve management approach, and regulatory positioning of Allyswift.Exchange, including its status as a registered Member of Ghana’s Virtual Asset Service Provider (VASP) framework, for supervisory understanding by the Bank of Ghana.

2. Regulatory Status

Allyswift.Exchange is a registered Member of Ghana’s VASP framework. This registration is maintained to ensure regulatory visibility, supervisory engagement, and forward-looking compliance should future virtual-asset-related services be introduced subject to approval. Current operations do not involve active virtual asset issuance or trading.

3. Current Operational Model

In its current phase, Allyswift.Exchange operates as a fiat-only, Ghana Cedi (GHS) closed-loop platform.

Key characteristics:

- All user-facing balances are denominated exclusively in GHS

- Transactions are domestic and closed-loop

- No crypto assets, stablecoins, or tokens are issued, listed, or traded

- No customer-facing foreign currency wallets exist

- No FX exchange services are provided

- The platform does not currently accept public deposits

All funds presently associated with the platform belong solely to HRM King Torgbi Xenodzi Dogbey II, and the system is being piloted internally pending regulatory-aligned settlement and off-ramp approvals.

4. USD References and Clarification

Any references to USD within Allyswift.Exchange documentation or website materials relate solely to internal reserve backing. Users:

- Cannot see USD balances

- Cannot hold USD

- Cannot convert currencies

- Cannot transact in foreign currency

There is therefore no functional or regulatory equivalence to crypto exchanges or stablecoin platforms.

5. Reserve Structure and Capital Protection

USD reserves are held in a private, segregated custodial account outside Allyswift.Exchange. These reserves are:

- Externally held

- Fully segregated

- Not lent or leveraged

- Not commingled with platform operations

This structure reflects international best practice for large reserve holdings, commonly used by sovereign wealth funds, central banks, institutional treasuries, and family offices, where traditional bank deposit insurance frameworks do not adequately protect balances of significant size.

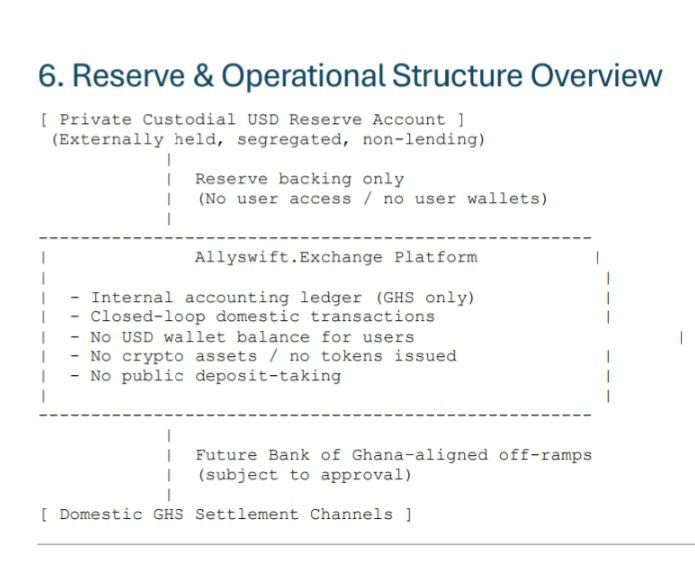

6. Reserve & Operational Structure Overview

[ Private Custodial USD Reserve Account ] (Externally held, segregated, non-lending) | | Reserve backing only | (No user access / no user wallets) | ----------------------------------------------------- | Allyswift.Exchange Platform | | | | - Internal accounting ledger (GHS only) | | - Closed-loop domestic transactions | | - No USD wallets for users | | - No crypto assets / no tokens issued | | - No public deposit-taking | | | ----------------------------------------------------- | | Future Bank of Ghana–aligned off-ramps | (subject to approval) | [ Domestic GHS Settlement Channels ]

7. Regulatory Interpretation

Although Allyswift.Exchange is a registered VASP Member, its current operations fall outside active virtual asset activity. The platform’s design ensures:

- No crypto exposure to users

- No FX exposure

- No public deposit-taking

- No trading or exchange functionality

VASP membership serves as a precautionary compliance posture and ensures that any future expansion into regulated virtual asset services would occur only with appropriate approvals and supervisory oversight.

8. Conclusion

Allyswift.Exchange presently operates as a conservative, GHS-only, closed-loop digital value system, with externally held reserves, no public deposits, and no virtual asset activity. Its VASP registration reflects regulatory alignment and future-readiness rather than current crypto operations, ensuring transparency and supervisory engagement while maintaining strict adherence to Ghana’s domestic payment and electronic money principles.

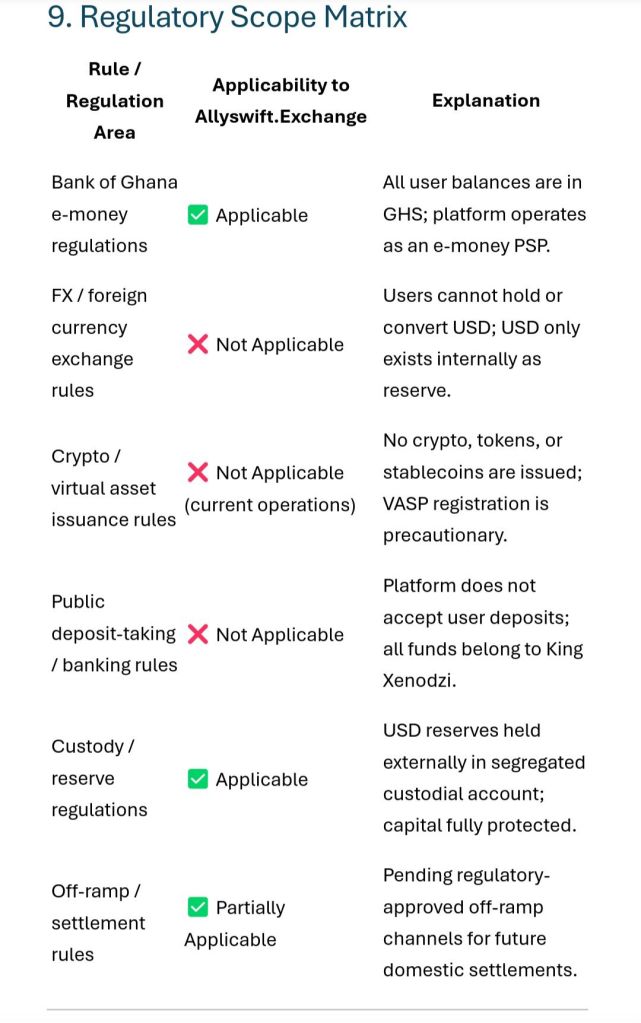

9. Regulatory Scope Matrix

Rule / Regulation Area Applicability to Allyswift.Exchange Explanation Bank of Ghana e-money regulations ✅ Applicable All user balances are in GHS; platform operates as an e-money PSP. FX / foreign currency exchange rules ❌ Not Applicable Users cannot hold or convert USD; USD only exists internally as reserve. Crypto / virtual asset issuance rules ❌ Not Applicable (current operations) No crypto, tokens, or stablecoins are issued; VASP registration is precautionary. Public deposit-taking / banking rules ❌ Not Applicable Platform does not accept user deposits; all funds belong to King Xenodzi. Custody / reserve regulations ✅ Applicable USD reserves held externally in segregated custodial account; capital fully protected. Off-ramp / settlement rules ✅ Partially Applicable Pending regulatory-approved off-ramp channels for future domestic settlements.

10. Executive Summary

Allyswift.Exchange: Operational and Regulatory Summary

- Nature of Platform: GHS-only, closed-loop digital payments platform; not a cryptocurrency exchange; no tokens, stablecoins, or virtual assets issued.

- VASP Registration: Registered Member of Ghana’s VASP framework for regulatory engagement and future-readiness. Current operations do not involve virtual asset issuance or trading.

- User Transactions: All balances and transactions in GHS; no USD holding, conversion, or deposits.

- Reserve Structure: USD backing in segregated, external custodial account; not lent or leveraged; follows international best practice (sovereign wealth funds, central banks, treasuries).

- Compliance: Fully aligned with BoG e-money regulations; avoids FX, crypto, and public deposit rules.

- Pilot Status: Internal closed-loop pilot; future off-ramps subject to regulatory approval.

- Value Proposition: Provides secure, fully-backed digital payments, trust, and domestic financial inclusion.

Leave a comment